Watch The Video Below To Find Out How To Add Measurable, Bankable Value to Clients and Open a New Revenue Stream — In Minutes

How To Get Paid To Help Your Clients Save $1000s of Dollars Per Year, Without Giving Tax Advice, Taking on Liability, or Adding Anything To Your To‑Do List

In Less Than (X) Days, Even If You Have No Experience/Money/Time

The more you can stimulate CURIOSITY with the headline, the more people will watch the video

S‑Corp Tax Efficiency Referral Alliance

As soon as you enroll, you’ll get your portal login, your codes and link, and the materials to start sharing immediately. If you want a quick Q&A before you enroll, there’s a calendar option to grab a short slot with my team. When clients use your code or link, your dashboard updates and your payout is queued. Your clients receive the same deliverables we provide every day: the market‑justified salary and the audit‑ready package.

From $1,499 Down To

$497.00

(You Can Add An Urgency Based Message Here If You Like.. "After 100 Applicants The Price Goes Up")

Join Our Partner Community

As Seen On....

ONBOARD IN MINUTES

NO TAX ADVICE LIABILITY

AUTOMATED $100–$150 PAYOUTS

UP TO $200 CLIENT DISCOUNT

HERE IS WHAT I AM GIVING YOU..

The 3 Major Parts Of S‑Corp Tax Efficiency Referral Alliance

5 Minute Fast‑Track Affiliate Onboarding

You’ll see a short, interactive walk‑through on account setup, payout tiers, and discount code configuration — designed so a busy professional can complete everything in minutes. We issue custom discount codes that give your clients up to $200 off and a unique affiliate URL that attributes conversions to you automatically. A self‑serve portal lets you watch referrals move from click to conversion and view your current payout tier. You’ll see automated payouts ranging from $100 to $150 per referral, clear, current, and simple to reconcile.

Done For Your Client – S‑Corp Salary Optimization

We deliver a professional S‑corp salary analysis with about thirty minutes of client input, often uncovering $5,000–$10,000 in annual savings, and up to $20,000 when the facts support it. The audit‑ready documentation aligns to IRS salary rules, with methodology and market sources described in plain language so clients can present the file with confidence. Use step‑by‑step email and call scripts to bring on qualified colleagues; when they refer a sale, you see an additional $50 per converted client added to your dashboard.

Ready‑To‑Send Co‑Branded Promotion Pack

Drop your logo into pre‑built emails and landing page copy that highlight tax‑savings and compliance benefits in straightforward language. Use the on‑demand explainer that handles the “why” and the “how” so you don’t have to. It covers what “reasonable compensation” means in practice and what the client receives at the end. You point, they watch, they understand, and they book.

Ready‑To‑Send Co‑Branded Promotion Pack

Drop your logo into pre‑built emails and landing page copy that highlight tax‑savings and compliance benefits in straightforward language. Use the on‑demand explainer that handles the “why” and the “how” so you don’t have to. It covers what “reasonable compensation” means in practice and what the client receives at the end. You point, they watch, they understand, and they book.

Done For Your Client – S‑Corp Salary Optimization

We deliver a professional S‑corp salary analysis with about thirty minutes of client input, often uncovering $5,000–$10,000 in annual savings, and up to $20,000 when the facts support it. The audit‑ready documentation aligns to IRS salary rules, with methodology and market sources described in plain language so clients can present the file with confidence. Use step‑by‑step email and call scripts to bring on qualified colleagues; when they refer a sale, you see an additional $50 per converted client added to your dashboard.

Client Case Study:

S-Corp Tax Optimization

Industry: Retail (Flower Shop with Greenhouse)

Business Structure: C-Corporation → S-Corporation

Original W-2 Salary: $180,000

"I ran this analysis for a friend who operates a flower shop with greenhouse. His salary was around $180k. With a detailed report split into 19 job categories and realistic proficiencies, we got his salary down to $74,210. As an S-Corp, he would save roughly $19,752. The $20k in savings per year is absolutely achievable."

— Barry

Optimization Results

Reasonable Salary Analysis: 19 job categories with proficiency mapping

Optimized W-2 Salary: $74,210

Annual Tax Savings: $19,752

Ready To Optimize Your Business Tax Strategy?

Insert Name: Achieved Outcome X In Y Days

Insert Name: Achieved Outcome X In Y Days

Insert Name: Achieved Outcome X In Y Days

OUR OFFER TO YOU

When You Book Your FREE Enrollment Call For The 'S‑Corp Tax Efficiency Referral Alliance', You’re Going To Get:

5 Minute Fast‑Track Affiliate Onboarding

Short, interactive walk‑through on setup, payout tiers, and discount codes.

Designed so a busy professional can complete everything in minutes

No integrations and no back‑and‑forth required to go live.

Move straight to serving clients without training or tech headaches.

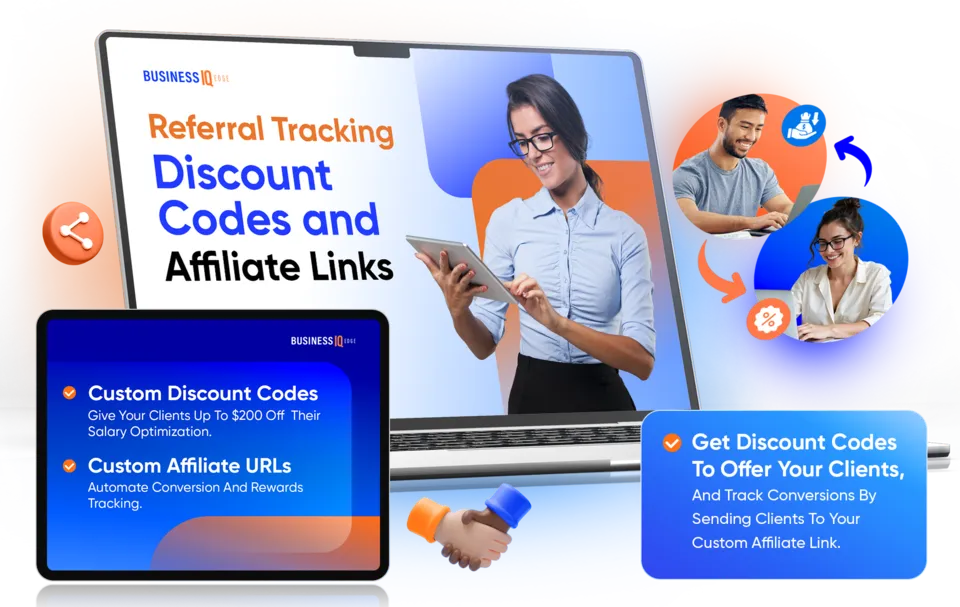

Referral Tracking Discount Codes and Affiliate Links

Custom codes give your clients up to $200 off the $997 package.

Unique affiliate URL attributes conversions to you automatically every time.

Share a code or a link and let tracking handle the rest.

Discount‑only track available for banks, associations, or organizations.

Live Referral Rewards Dashboard

Watch referrals move from click to conversion in real time.

View your current payout tier and automated payouts at a glance.

Automated payouts range from $100 to $150 per referral.

Clear, current, and simple to reconcile inside your portal.

Client‑Focused Salary Optimization Educational Webinar

On‑demand explainer that handles the “why” and the “how.”

Covers what “reasonable compensation” means in practice for clients.

Shows what the client receives at the end of the process.

You point, they watch, they understand, and they book.

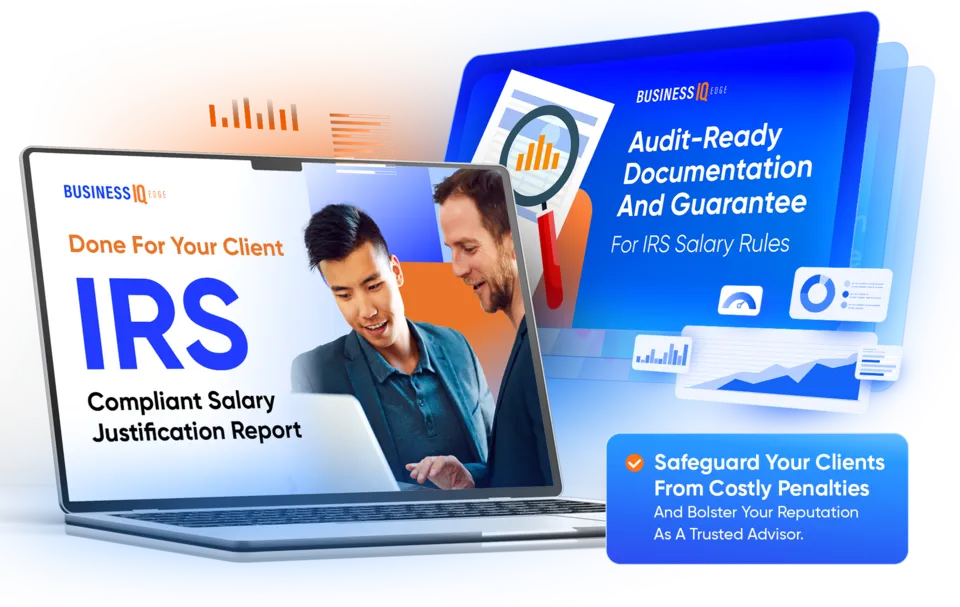

Done For Your Client – S‑Corp Salary Optimization

Professional salary analysis with about thirty minutes of client input.

Often uncovers $5,000–$10,000 in annual savings; up to $20,000 when facts support it.

The client doesn’t deal with the math or the rules — we do.

You keep your role clean while clients keep more of what they earn.

Done For Your Client – IRS Compliant Salary Justification Report

Audit‑ready documentation aligned to IRS salary rules and expectations.

Methodology and market sources described in plain language for reviewers.

Clients present the file with confidence if anyone asks how wages were set.

Matches the work the client actually performs, organized and defensible.

Done For You Scripts and Emails To Grow Your Sub‑Affiliate Network

Step‑by‑step email and call scripts to bring on qualified colleagues.

Coaches, advisors, and service providers who serve the same client profile.

Receive $50 per converted client from your sub‑affiliate’s referrals.

See those payouts accrue in the same dashboard automatically.

The 'Offer Element 8' With Very Brief Description

How Does This Element Increase Your Probability Of Achieving The Outcome

How Does This Element Reduce Your Time Delay Associated With Outcome

What That You Hate To Do (Effort) Do You No Longer Have To Do, Now That You Have This Element

What That You Love To Do (Sacrifice) That You'll Get To Keep Doing, Now That You Have This Element

Is This A Unique Outcome Only Achievable Via This Product/Service

The 'Offer Element 9' With Very Brief Description

How Does This Element Increase Your Probability Of Achieving The Outcome

How Does This Element Reduce Your Time Delay Associated With Outcome

What That You Hate To Do (Effort) Do You No Longer Have To Do, Now That You Have This Element

What That You Love To Do (Sacrifice) That You'll Get To Keep Doing, Now That You Have This Element

Is This A Unique Outcome Only Achievable Via This Product/Service

All Of This Is Included When You Enroll Below

Join The Partners Adding Measurable, Bankable Value

Your journey to adding a new value stream starts with enrolling on this page.

Book Your Free Enrollment Session To The S-Corp Tax Efficiency Referral Alliance

As soon as you enroll, you’ll receive your portal login and see a short onboarding walk‑through. Next, grab your discount code and affiliate link so attribution is automatic. If you want a quick alignment call, book a time that fits your day. Then point clients to the webinar or send a co‑branded email — your dashboard updates when they enroll or use your code.

From $1,499 Down To

$497.00

(You Can Add An Urgency Based Message Here If You Like.. "After 100 Applicants The Price Goes Up")

INSERT GUARANTEE OR RISK REVERSAL - EX: 100% MONEY BACK GUARANTEE

Try For (X) Days, Risk-Free, When Joining Today

Enrollment is straightforward — and it’s probably better you get the additional sub‑affiliate income instead of your colleagues.

IMMEDIATE

ACCESS

OPTIONAL

Q&A

SECURE ENROLLMENT

Take The Next Step

Book Your Free Enrollment Session To Get Started

I’m opening up my calendar and offering a free 30 minute call where I’ll walk through exactly how we can help you add measurable, bankable value for clients. I’ll also show you how you can avoid giving tax advice, avoid liability, and avoid adding another program to manage. Please select a time below that’s convenient for you.

Frequently asked

questions

Here’s the answers to the most commonly asked questions about (insert product/service name).

What is the S‑Corp Tax Efficiency Referral Alliance?

It’s a turnkey channel for delivering a credible, IRS‑defensible salary optimization to your clients without adding anything to your to‑do list. You connect clients using your discount code or link, and our team handles the analysis and documentation. You get credit for the solution and get paid for the referral. One referral. One client helped. One payout to you.

Do I need to give tax advice or take on liability?

No. That’s the point. You’re not advising on wages. You’re connecting a client to a qualified team that completes a market‑backed analysis and delivers an audit‑defensible report. Your role is to recognize the need and make the introduction.

How fast is onboarding?

You get 5 Minute Fast‑Track Affiliate Onboarding with a short, interactive walk‑through. It’s designed so a busy professional can complete everything in minutes and move straight to serving clients. No integrations and no back‑and‑forth.

How does tracking and attribution work?

We issue custom discount codes and a unique affiliate URL so conversions attribute to you automatically. When a client uses your code to secure their discount, you get paid; when they click your link and enroll, tracking handles the rest. You’ll never dig through spreadsheets or wonder where a referral went.

What payouts can I expect?

Your live dashboard shows automated payouts ranging from $100 to $150 per referral as you hit your tiers. You’ll see concrete numbers updated in real time, along with your current payout tier. The goal is straightforward: keep it simple, keep it fair, and reward consistent partners.

What if I’m a bank, association, or organization that can’t accept payouts?

We switch you to a discount‑only track so your clients still benefit and you look great for bringing this to them. Your first fifty clients receive a $200 discount off the $997 package, and every client after that receives a $100 discount. Same deliverables. Same client result.

What do my clients receive?

About thirty minutes of intake, then a market‑justified salary and the package to support it. That includes the formal report that ties duties and hours to comparable wages, minutes templates to record the decision, and a plain‑language blueprint explaining the factors reviewers look for and how to keep the figure current. They walk away knowing their number, in writing.

How much can clients save?

Clients can often save $5,000–$10,000 a year and, in the right fact pattern, save up to $20,000. Shift $25,000 from wages to distributions and that’s about five thousand dollars in annual savings. If a client is overpaying wages by $50,000, that’s roughly ten thousand dollars in avoidable payroll tax every year.

What exactly do I get for promotion?

A Ready‑To‑Send Co‑Branded Promotion Pack and a Client‑Focused Salary Optimization Educational Webinar. Drop your logo into pre‑built emails and landing page copy; point clients to the on‑demand explainer that handles the “why” and the “how.” You point, they watch, they understand, and they book.

What does the dashboard show me?

A live, self‑serve portal where you can watch referrals move from click to conversion. You can view your current payout tier and keep track of automated payouts. It’s clear, current, and simple to reconcile — exactly how many professionals prefer to manage their practice.

How do sub‑affiliates work?

Use Done For You Scripts and Emails To Grow Your Sub‑Affiliate Network. Bring on qualified colleagues, coaches, advisors, and service providers who serve the same client profile. When they refer a sale, you receive $50 per converted client, automatically added to your dashboard.

Does this add to my workload?

No. You onboard in minutes, share a code or a link, and let the webinar and our team handle education and delivery. Your energy stays focused on your core work. That’s how you add a new value stream without managing another program.

Who is a good fit to refer?

Banks, advisors, coaches, and service providers with clients who are S‑corp owners needing salary guidance that keeps them compliant and helps them keep more of what they earn. Most accountants don’t even know about this strategy, so you’re often the first to put it on the client’s radar.

What if clients ask technical questions I’m not comfortable answering?

Point them to the webinar and the process. We complete the market‑backed analysis and deliver an audit‑defensible report. You’re not the tax expert here; you’re the connector who brought them substantial tax savings and a credible path.

How does this affect retention and referrals in my practice?

When you bring a client something that clearly saves them money or keeps them out of a compliance problem, you shift from “vendor” to “trusted source.” Clients stay. They tell their circle. Your pipeline grows with people who already believe you bring real solutions.

Is there any example of how this compounds?

Imagine even 100 clients benefiting — that’s 100 happier clients and $10,000 in referral revenue. Refer four colleagues who each serve fifty clients, and that’s another $10,000 per year from sub‑affiliates. Your clients do this every year, which makes it an annual salary boost.

What happens right after I enroll?

You’ll get your portal login, your codes and link, and the materials to start sharing immediately. If you want a quick Q&A, there’s a calendar option to grab a short slot with the team. Send a co‑branded email or point clients to the webinar — your dashboard updates as referrals convert.

What’s the guiding principle behind this program?

Compliance first, optimization second. When wages reflect the work actually performed and the documentation is in order, the savings that show up are a by‑product of doing things the right way. You don’t need to be the tax expert to deliver tax value — you need a credible path, a trustworthy team, and a clean way to share it.